This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Thursday. This is TheStreet’s Stock Market Today for Feb. 19, 2026. You can follow the latest updates on the market here in our daily live blog.

Update: 9:30 – 10:00 a.m. ET

Opening Bell

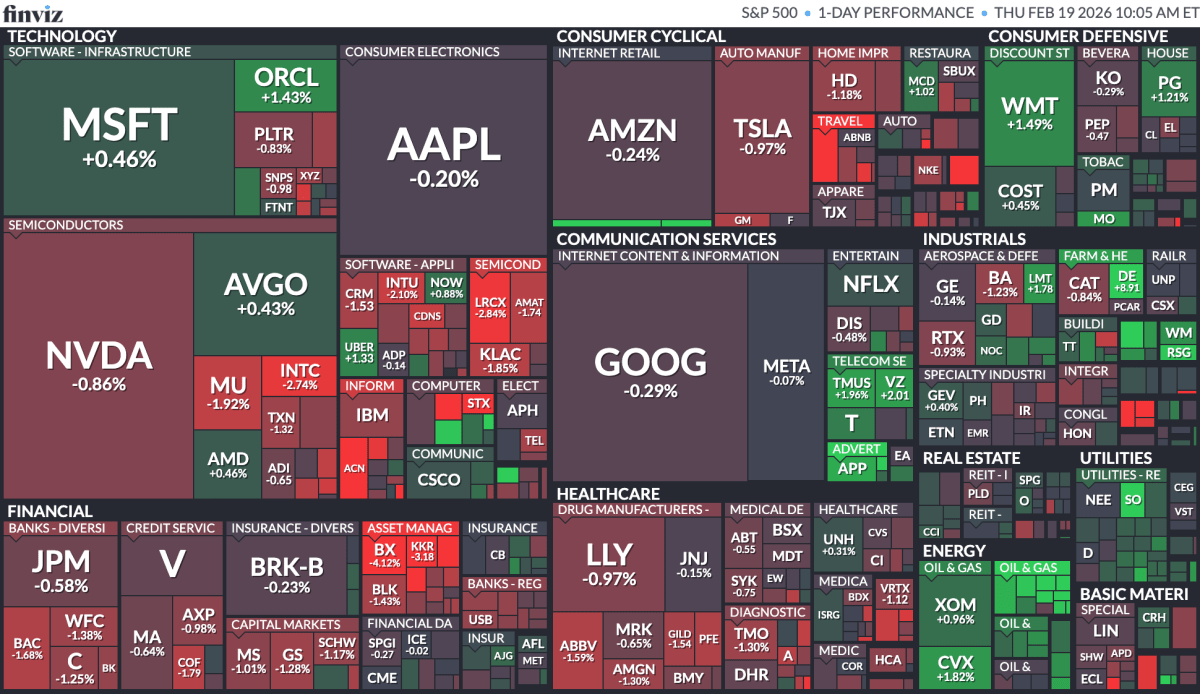

The stock market is open. This morning, 60.7% (3,373) U.S. issues are declining according to FinViz, with yesterday’s FOMC Minutes and this morning’s economic data appearing to do a number on stocks this morning.

At first glance, investors are still marinating on it. The Nasdaq (-0.08%) and S&P 500(-0.13%) are both down by a few basis points out of the gate, while the Dow (-0.39%) and Russell 2000 (-0.51%) have undone yesterday’s gains. However, with the session barely started, it appears the indexes’ declines could be steepening. We’ll check back in soon.

S&P 500 In Focus

In S&P 500 related antics, just five sectors of the index are in the green today, lifted by energy (+1.37%), utilities (+0.86%), and communication (+0.62%). On the flip side, financials (-0.68%), health care (-0.65%), and discretionary (-0.63%) are seeing the largest declines.

On Iran Watch

Per reports from the last few days, President Donald Trump appears keen to involve the U.S. in a conflict with Iran, which has pushed up the price of various commodities. Today, those commodities are more tempered, even as the President foreshadows the use of force in the region. Continuous futures in Gold (+0.38% to $5,028.30) and Silver (+0.55% to $78.025) are getting a nice bump from the worries. Crude Oil (+2.04% to $66.38) is leaping by even bigger amounts because of the possible effects.

Dollar Time

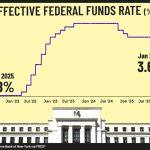

This morning, the Dollar Index hit a four-week high, at 98.074. That’s a nice recovery after President Donald Trump’s new Fed nominee, Kevin Warsh, briefly shook up the markets with worries about his more dovish attitude on the markets. Concurrently, the 10Y Treasury today is just 0.7 bips higher at 4.088%.

Update: 9:01 a.m. ET

A.M. Update

Good morning. Stock futures this morning appear to be down, continuing a late day decline from yesterday. It appears to be related to the release of the Federal Reserve‘s FOMC Minutes, which showed a mix of perspectives on the trajectory for interest rates. We’ll have more on that once the market opens in about 30 minutes.

Until then, let’s take a look at this morning’s earnings and economic data slate that awaits:

A.M Earnings: Walmart, Deere, Rio Tinto

This morning, retail giant Walmart reported earnings, joined by Deere, Rio Tinto, and Southern Company, among others. Stocks with their price in green have started off the day in the green after their earnings, a sign of a positive report.

Economic Data + Events

This morning has been anticipated for the sheer volume of economic data on the docket, much of which is already out:

- Initial Jobless Claims(Feb. 14): 206K (down from 229K last week)

- Continuing Claims (Feb. 7): 1.869 million (up from 1.852 million)

- Both the Balance of Trade and Goods Trade Balance worsened as imports rose; exports declined.

- Despite that, the Philadelphia Fed Manufacturing Index (Feb) came in at 16.3, up from 12.6 last month.

There’s also plenty more to come after the market opens: